Velixo: Excel Reporting for Acumatica

Build Your Own Reports in Excel With Live Data in Less Than 5 Minutes

1 min read

Murray Quibell

May 9, 2023 8:48:40 AM

Murray Quibell

May 9, 2023 8:48:40 AM

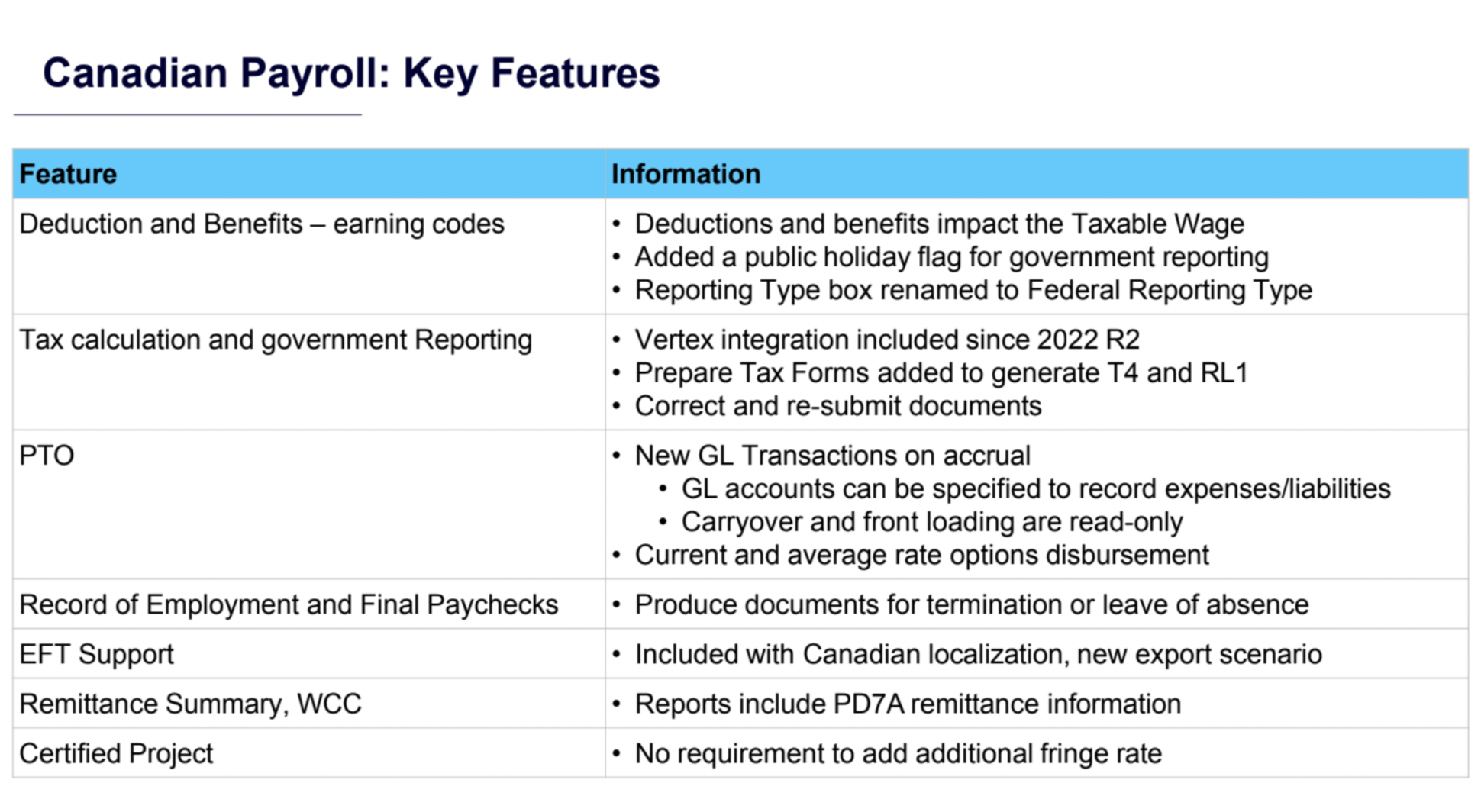

Our recent Acumatica 2023 R1 Key Themes webinar highlighted the benefits of the Acumatica Canadian Payroll and its key features. Streamline your payroll setup, processing, and reporting, and reduce data entry with a unified payroll and Cloud ERP solution. Increase the accuracy of your data by automatically pulling time entry data into the payroll system. With Acumatica Payroll, you can eliminate the cost and complexity of maintaining an external payroll system and benefit from time flowing seamlessly across financials, project accounting, business intelligence, distribution, manufacturing, construction, and field service.

Whether your payroll needs are simple or highly sophisticated, Acumatica Canadian Payroll will make it easy to pay your employees and manage tax filings, specifically designed to handle payroll processing for Canadian businesses.

Canada-based companies can manage various payroll-related functions, such as tax calculations, EFT support, final paycheques and record of employment, certified project calculations, and Canadian tax reporting for all provinces. The solution maintains employment records per government regulations and automates bank transactions and EFT transfers per Canadian standards.

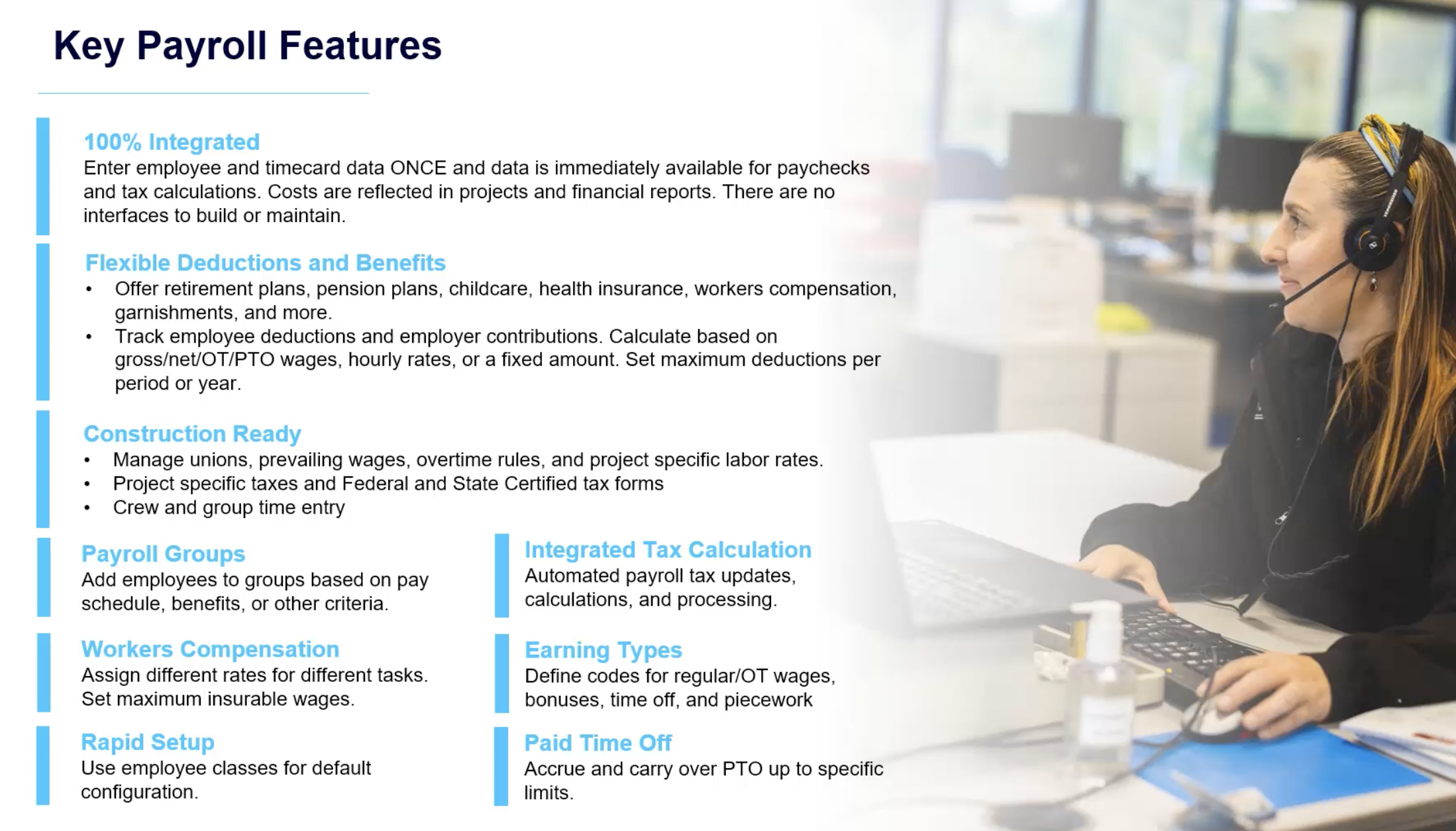

The Canadian Payroll module in Acumatica Cloud ERP streamlines and automates the payroll process, ensuring accurate and timely employee payment. Some key features and functionalities of the cloud-based payroll software include:

Payroll calculations: The module facilitates the calculation of employee wages, considering factors such as regular hours, overtime, vacation pay, statutory deductions, and other payroll-related parameters.

Payroll tax management: It helps manage various payroll-related taxes applicable in Canada, such as federal and provincial income tax, employment insurance (EI), Canada Pension Plan (CPP), and other deductions specific to Canada.

Compliance with government regulations: The module stays up-to-date with Canadian payroll regulations and tax laws, ensuring that payroll processing complies with legal requirements and obligations.

Direct deposit and cheque printing: Acumatica Cloud ERP allows for direct deposit of employee wages into their bank accounts and printing cheques for those who prefer physical payment.

Employee self-service: The Canadian Payroll module provides a self-service portal for employees to access and review their payroll information, such as pay stubs, tax documents, and year-end statements.

Reporting and analytics: The module generates various payroll reports, such as payroll registers, tax reports, and year-end statements, providing valuable insights and data for analysis and compliance purposes.

• Add employees • Add timecards • Run payroll • PrepareAP bills for benefits • Prepare taxes • Show reports

Overall, the Canadian Payroll module in Acumatica Cloud ERP simplifies and automates the payroll process, ensuring accuracy, compliance, and efficiency for Canadian businesses.

Build Your Own Reports in Excel With Live Data in Less Than 5 Minutes

Initial Public Offering (IPO) Planning: Propel Your Canadian IPO Success By Implementing the Right Technology and Automation As you transition from...

When Aqurus’ founder, Murray Quibell, CPA, CA, CITP, first saw Acumatica Cloud ERP, he was incredibly impressed with both the solution and the...